Do you have in mind which initiatives you want to do next? How do you prioritize?

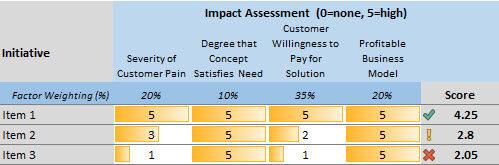

Often, parsing out the key, individual decision factors can get everyone on the same page. Creating a Decision Matrix is a great tool for this:

List the items under consideration.

Enumerate the factors that will make the most difference in product success- whatever factors make sense for your product/market. Weight these factors in importance.

- Pull together a team session to quickly gain consensus on each factor’s impact for each initiative. (Including an outsider in the group can really help get over group-think.)

Use this simple tool to break down the essential elements of decision making and turn argumentation into data-point discussions.