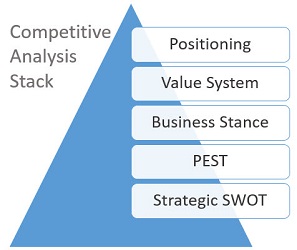

Customers evaluate your products relative to competing products. So use a structured approach to assess competitors. (Hint, it’s not just a feature matrix.)

Pick the top 2 competitors and analyze each using this stack. (Don’t forget that a key competitor may not be a competitor at all, but rather, a non-product substitute for the value that your product would provide.)

Positioning

What mind-space (accepted value proposition) do competitors hold in the customer’s mind. (e.g.: most current; easiest to use; most cost effective; etc.) Why?

Value System

Assess not just benefits and features, but the entire product value system of competitor products (including such things as service, distribution, integration, etc.) Any of these may represent a key competitive factor that you must address.

Business Stance

Assess competitor performance, funding, spending, marketing/sales details, and business objectives.

PEST

Add critical context by assessing the Political/Legal, Economic, Social, and Technological trends that are impacting competitors (and you).

Strategic SWOT

Competitor SWOT is not just their catalog of strengths, weaknesses, opportunities and threats- but an assessment of the approaches that competitors are/may implement to leverage strengths against their opportunities and threats, as well as how they are/will mitigate weaknesses against opportunities and strengths.

A more in-depth understanding of competitors can point the way to improved positioning, selling, and market performance for your product.